India’s private market is a vibrant and dynamic ecosystem. It hosts a diverse set of players—emerging startups, private equity firms, investment banks, venture capital companies, established conglomerates, and a rapidly growing cohort of family offices. Each of these entities engages with capital differently—deploying, raising, or preserving it in line with their strategic goals. Yet, amid these widely recognized actors, there exists an influential but underrepresented segment: a group of powerful, largely family-owned enterprises that, while dominant in their sectors, remain on the periphery of private market narratives.

To bring these institutions to light and underscore their pivotal role in the private market ecosystem, VCCEdge has coined the term ‘Legacycorns’—an emerging class of wealth custodians that remain rooted in family ownership but have not institutionalized their investments through creation of an entity/family office. These businesses are not just witnesses to India’s economic evolution—they’ve been central to it. Their scale, heritage, and capital strength make them not just participants but potential accelerators of India’s private market growth.

Understanding Legacycorns

While India has witnessed a notable rise in registered family offices in recent years, a significant number of large family-run enterprises continue to operate outside this shift. These companies, often the result of decades of enterprise-building, hold vast generational wealth and industry influence—but have not yet translated their success into institutionalized capital allocation strategies.

At VCCEdge, we define Legacycorns as privately held companies with ≥₹500 crore revenue and ≥50% shareholding by a single family or trust. These are not startups or unicorns, but enduring enterprises shaped by decades of enterprise-building, each carrying distinct family ethos and investment philosophies. To better understand this diverse and highly differentiated group, a dedicated team of analysts at VCCEdge is continually studying them to assess their propensity to invest and the unique patterns that guide their capital decisions.

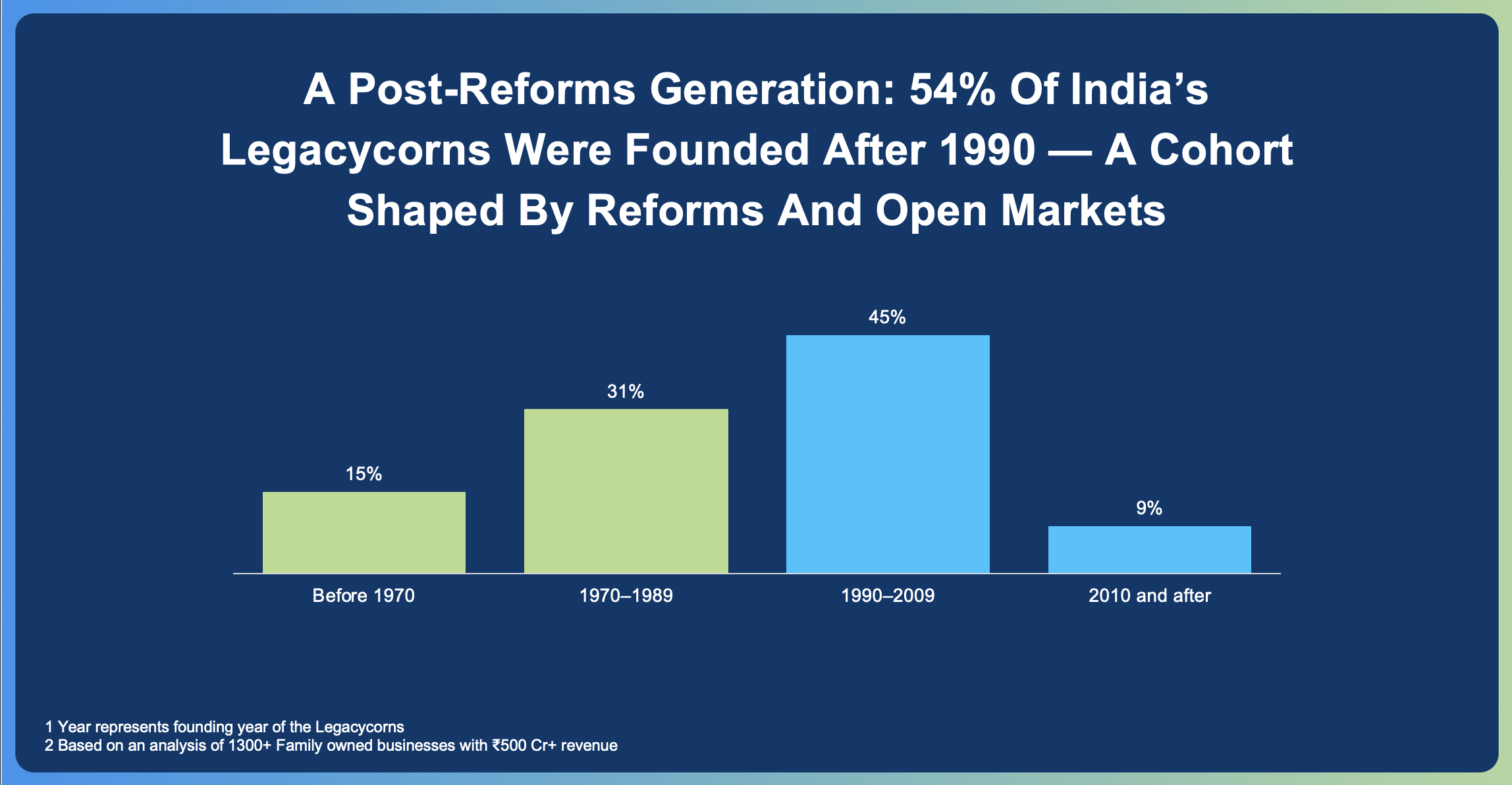

Roughly one in two of India’s approximately 2,500 large private companies qualify as Legacycorns. Despite their legacy roots, many are relatively young in historical terms—about 54% were founded post-1990 (based on VCCEdge analysis), shaped by India’s economic liberalization and market reforms. This positions them at the confluence of traditional business acumen and modern market exposure—a unique blend that could redefine private market participation.

Scale Meets Succession: The Shifting Landscape

India is home to 1,300+ Legacycorns, yet their participation in private markets remains limited—just over 100 transactions since 2020, amounting to approximately $2.3 billion. This gap between scale and market activity underscores the presence of a vast, underutilized capital pool that could meaningfully reshape India’s investment landscape.

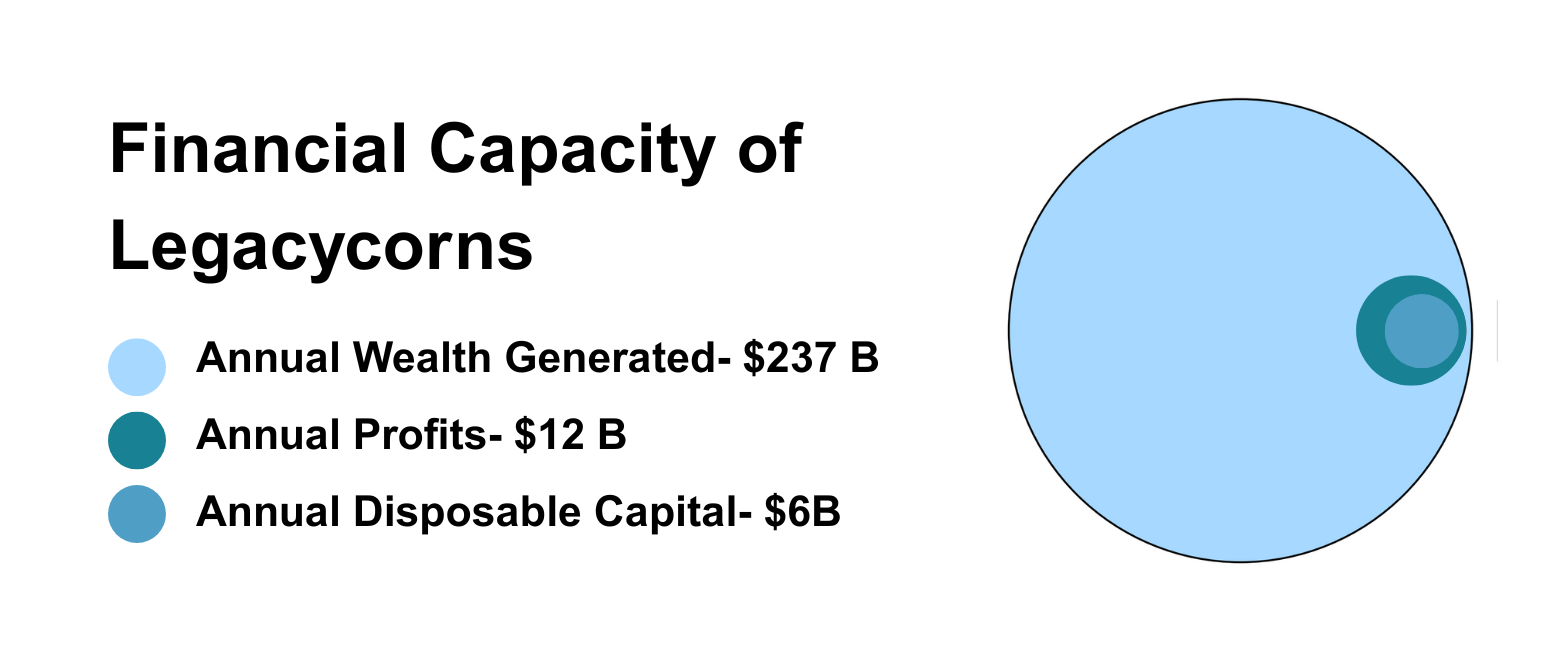

The magnitude of this opportunity becomes clear when looking at their financial capacity. Collectively, Legacycorns generate over $237 billion in annual revenue and $12+ billion in profits (PAT), leaving an estimated $6+ billion in disposable capital. Even if a portion of this surplus was directed toward the private market, it could unlock substantial domestic funding capacity—strengthening capital availability, reducing reliance on foreign investors, and accelerating market growth.

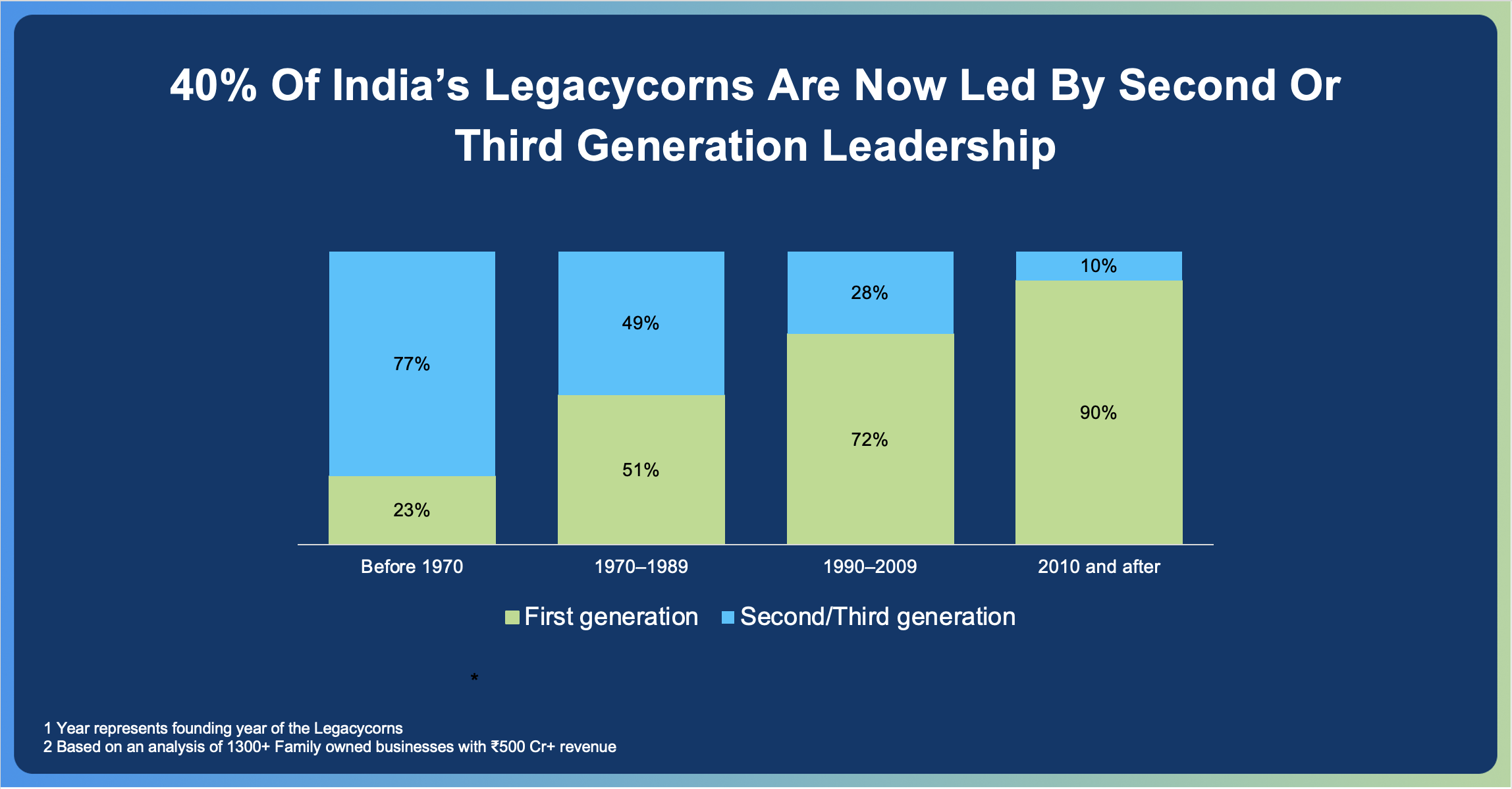

This is likely to happen as leadership dynamics evolve. Roughly 60% remain under first-generation leadership, many of whom are approaching a natural inflection point as succession planning takes shape. Succession will pair significant legacy wealth with a more diversified, portfolio-style investment approach. The other 40% are already led by second- or third-generation decision-makers, a cohort far more attuned to emerging asset classes, structured investment vehicles, and global portfolio strategies. As this shift unfolds, Legacycorns’ participation in private markets is poised to rise sharply, mobilizing domestic capital to fuel the next phase of growth.

Anitesh Dharam, Business Head, VCCircle & VCCEdge, remarks, “Legacycorns bring far more than just capital to the table—they bring decades of experience in building and running successful businesses, a deep understanding of market cycles, and an ethos grounded in long-term value creation. For founders, this is capable capital—money backed by insight, discipline, and the ability to navigate growth with resilience. In the current founder ecosystem, this kind of partnership is invaluable. Legacycorns have the potential to not only fund the next generation of companies but to guide them in building legacies of their own.”

The Evident Gap: Why Legacycorns Are Not Yet Mainstream

Despite being materially more than 4x the number of family offices, Legacycorns have had surprisingly limited involvement in private equity transactions—just over 100 deals since 2020, compared to 650+ by family offices during the same period. This disparity raises important questions about barriers and bottlenecks.

Several factors contribute to this under-participation:

- Lack of advisory and strategic handholding: Many Legacycorns have had limited exposure to the private market simply because they require structured handholding to navigate it effectively. Platforms like VCCircle play a crucial role in bridging this gap—bringing family-owned businesses into the mainstream investment ecosystem by enabling their interaction with both the formal business environment and the startup community. Acting as a facilitator of the right partnerships, VCCircle is actively working on initiatives to integrate these enterprises more deeply into the investment landscape.

- Limited integration into investment-focused communities: Beyond access, active participation requires belonging to a trusted, knowledge-rich community. Many Legacycorns remain outside such circles, missing the flow of insights, relationships, and co-investment opportunities that drive market engagement. Purpose-built investment communities can close this gap—giving Legacycorns not just visibility into emerging opportunities, but also the confidence, peer validation, and strategic partnerships needed to translate capital into long-term value creation.

These challenges are not roadblocks, but indicators of untapped potential—urging ecosystem players, advisors, and the Legacycorns themselves to reevaluate their role in India's next wave of capital growth.

Next in the Legacycorns Series: Uncover the untapped potential that could redefine Legacycorns’ role in India’s private markets—exploring the opportunities that lie ahead.

No VCCircle journalist was involved in the creation/production of this content.